Decreasing the boundaries to ESG reporting with expertise | Information | Eco-Enterprise

Table of Contents

Firms, significantly public-listed corporations, are more and more anticipated to fulfill related reporting and disclosure necessities. Topic to larger public scrutiny of key environmental, social and governance (ESG) metrics from varied stakeholders, significantly from traders and potential companions, many corporations now want to offer detailed details about how they’re managing their pure, social and human capital, in addition to info past what’s historically collected, together with on their carbon footprints, enterprise conduct and labour practices.

Amassing, measuring and reporting these non-financial information, nevertheless, might be tough. ESG reporting has advanced shortly over a brief time period, with information high quality changing into a key focus, and new standards, similar to these for monetary information, are rising. Current worldwide pointers, such because the Worldwide Sustainability Requirements Board (ISSB) of the IFRS Basis, the Sustainability Account Requirements Board, and the International Reporting Initiative, to call just a few, are being consolidated on an ongoing foundation.

On the identical time, totally different frameworks are rising to differentiate between local weather, nature and carbon reporting, such because the Taskforce of Nature-Associated Disclosures, the Local weather Disclosure Requirements Board and the Carbon Disclosure Undertaking. ESG reporting stays an advanced and transferring panorama for corporations to navigate. Workers engaged within the assortment, validation and administration of ESG-related metrics should be communicated to and guaranteed of efficient controls that may improve the usability and readability of such information.

Firms could face the next challenges:

- Not realizing the place to begin and what information to report first

- Lack of assets to gather the wanted information

- Speaking clear reporting pointers to enterprise models

To ease this complicated course of, organisations could flip to expertise to strengthen their analytics capabilities.

“Globally, the sustainability expertise panorama is at a nascent part, however it’s quick evolving,” mentioned Arina Kok, Malaysia local weather change and sustainability companies chief and associate at world accounting agency Ernst & Younger (EY). The bottom line is to search out the appropriate applied sciences to put money into, as corporations remodel their enterprise fashions, she mentioned.

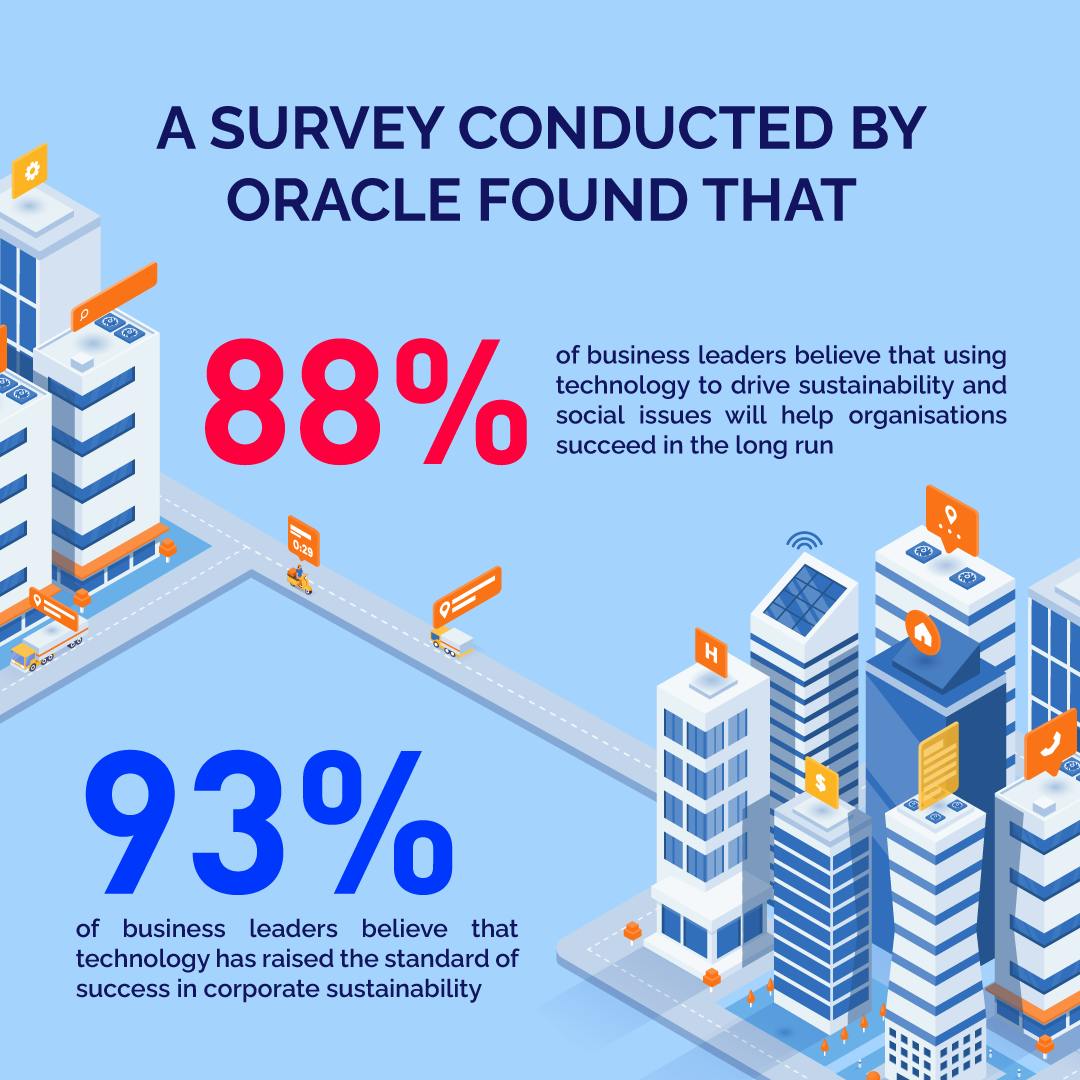

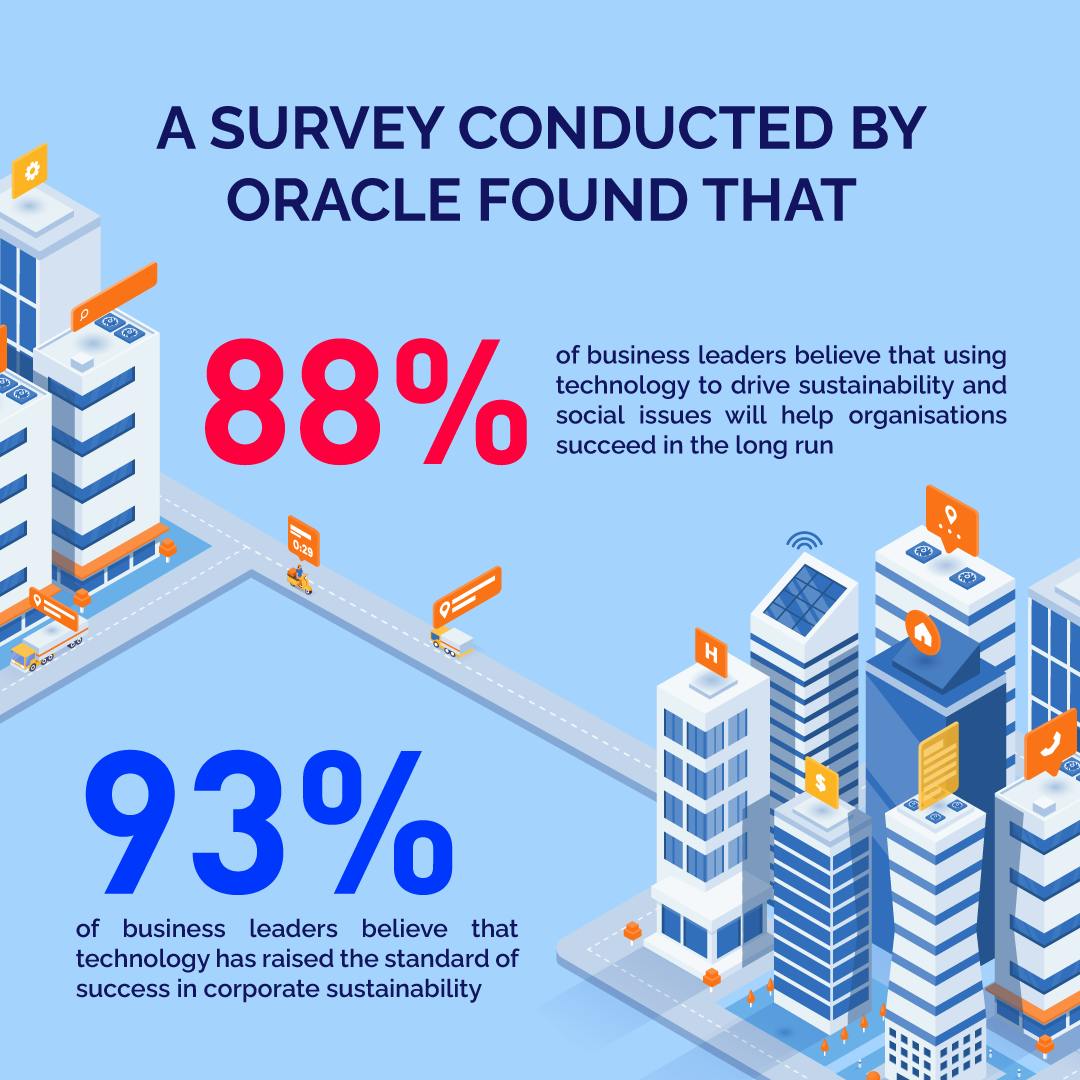

Supply: No Planet B: How Can Companies and Expertise Assist Save the World; 2022 ESG International Examine by Oracle and Savanta

An Oracle survey of greater than 11,000 customers and enterprise leaders throughout 15 markets discovered that 88 per cent of enterprise leaders imagine organisations that use expertise to assist drive sustainability and social points would be the ones to achieve the long term. These leaders recognized key areas they want help within the assortment and verification of knowledge, goal planning and revision primarily based on efficiency, in addition to report and evaluation automation. The survey report said that people and expertise mixed could make for significant change.

Malaysian corporations are forward of the curve, in line with a latest PricewaterhouseCoopers (PwC)’s

report. It discovered that amongst Asia Pacific international locations, Malaysia stands out for disclosures of boards’ duties and corporations’ ESG governance buildings. Additionally it is among the many two international locations in Asia Pacific that exhibit the very best degree of disclosure for mitigation methods.

“With ESG info more and more being utilized by the capital markets and varied stakeholder teams to make funding and buying selections, it has by no means been extra necessary to make sure that ESG disclosures are of top of the range,” mentioned Herbert Chua, Associate, Sustainability Reporting and Assurance at PwC Malaysia.

Listed here are 5 technology-driven options that may assist extra organisations enhance the standard of their ESG reporting.

1. Power administration techniques

Step one to understanding an organisation’s carbon footprint requires the gathering and administration of knowledge from varied sources. Power administration techniques (EMS) can assist the monitoring and optimisation of power consumption to preserve its utilization throughout an organisation’s bodily property, together with in factories and workplace buildings. Presently, ISO 50001, the worldwide power administration commonplace, specifies necessities for corporations to develop and implement a strong EMS, offering organisations with a framework that validates greatest practices referring to power effectivity, use and consumption. This often requires the gathering and evaluation of power consumption information, which might be carried out utilizing gadgets reminiscent of good meters, sensors and energy monitoring software program. Areas of serious power use and alternatives for enchancment are then recognized and organisations can higher perceive their power profile. In lots of circumstances, the ISO 50001 can also be used as a compliance route in assist of different environmental laws.

For instance, telecommunications agency Telekom Malaysia was capable of calculate their oblique emissions and waste era at eight websites that implement EMS. Utilizing their “unified electrical energy monitoring answer”, which incorporates superior power behaviour analytics and alert mechanisms, the group was capable of hold observe of emissions information in addition to cut back Scope 2 emissions – oblique emissions from the era of bought power – by 9.2 per cent in 2021.

One other firm that has benefited from monitoring power utilization via an EMS is IOI Oleochemicals, a subsidiary of IOI Plantations. The group defined that the expertise “gives visibility of power stream and power consumptions to realize optimum power effectivity”.

2. ESG information monitoring dashboards

Firms should not be misplaced within the deluge of knowledge as a result of they don’t have the right instruments to know and analyse it in alignment with a number of worldwide reporting requirements.

That is the place information warehouse and dashboard companies are available in. Cloud-based, central repository techniques allow organisations to collate ESG information from a number of sources, providing a single view of an organisation’s ESG efficiency.

Placing this into observe, telecommunications group Axiata has leveraged on a visible interactive dashboard together with their environmental information system. “These kind an necessary reference level to steer our brief and long-term targets in addition to motion plans,” mentioned Axiata.

Along with serving to the agency determine alternatives to enhance power effectivity, Axiata additionally mentioned that the dashboard can operate as a key communication platform, creating consciousness of the corporate’s emissions amongst staff.

3. Built-in ESG analytics platforms

Past ESG information assortment and assessment utilizing dashboards, there are actually analytics platforms that corporations can use for higher planning and optimisation of assets. These platforms use varied metrics to calculate impacts, create studies, unlock information for evaluation and supply actionable insights for corporations to behave on. The result’s an extra streamlining of an organisation’s ESG efforts.

Many software program suppliers now supply built-in sustainability-focused analytics options. Hong Kok Cheong, Managing Director of software program supplier SAP Malaysia, mentioned that when corporations have full transparency on their environmental footprint to watch and report on sustainability metrics, they’ll determine areas for enchancment and adapt to altering regulatory circumstances.

In its latest sustainability report, engineering, property and infrastructure firm Gamuda mentioned that using an analytics platform centered on useful resource planning, had helped in enhancing information processing and transparency.

“For the reason that digitalisation of procurement and provide chain processes, the Group had achieved greater than RM300 million in financial savings via provide chain collaboration to realize extra aggressive pricing in delivering superior values to mission stakeholders. A holistic digitalisation initiative in procurement eliminates important paper consumption which are circulating within the provide chain processes,” Gamuda mentioned.

4. AI and machine studying for situation planning

Synthetic intelligence and machine studying are a few of the new frontiers for corporations to navigate in terms of situation modelling. For corporations assembly particular United Nations’ Sustainable Growth Targets (SDGs) or different sustainability-related targets, information might be fed into scenario-based fashions within the context of their sustainability plans. With machine studying capabilities, patterns in useful resource allocation and alternatives for course of optimisation might be recognized.

For instance, client items large Unilever sought to enhance its logistic effectivity and cut back prices by deploying a multi-mode transportation administration system to achieve higher visibility of its operations and streamline its transportation fleet. The system expanded Unilever’s visibility of transport lanes. With using automated planning algorithms, car and container utilisation had been additionally optimised. Knowledge offered by Oracle Functions (Asean), which gives Unilever with the situation planning system, signifies that total emissions of the corporate’s transport emissions had been diminished by 9 per cent in consequence.

5. Interactive reporting

Speaking sustainability initiatives and metrics with varied stakeholders, from traders and clients to staff and suppliers, might be improved with interactive reporting applied sciences that make ESG information accessible and related to every group.

To this finish, a number of suppliers of the above-mentioned options, reminiscent of built-in ESG analytics platforms, have made it doable for each inner and exterior stakeholders to collaborate on information and ESG narratives. This consists of offering third-party distributors or suppliers with entry to enter their metrics, to present an organisation’s senior administration, board and traders a extra holistic overview of their provide chain.

As for traders and clients, interactive sustainability studies which are digital-first can enhance engagement and distribution. Easy tweaks, reminiscent of utilizing responsive design, could make studies extra accessible throughout totally different gadgets, whereas hyperlinks inside the report can broaden the entry readers need to an organisation’s current sustainable insurance policies or practices, additional enriching the ESG narrative.

“Buyers are more and more involved about greenwashing in ESG reporting, marking the decision for Public Restricted Firms (PLCs) to offer extra exact and clear non-financial info to assist steer their funding selections,” EY’s Kok mentioned.

“Reporting on the present state of ESG and sustainability will not be sufficient. The aim – in traders’ and clients’ minds – is to drive change, and for that, you want the info to inform you not solely the place you are actually but additionally the place it’s essential to go,” Oracle mentioned on their web site.

In the end, expertise is just as efficient as the aim it fulfils, PwC’s Chua mentioned. Organisations should make sure that underlying the implementation of recent expertise, rigorous processes and inner controls are utilized alongside efficient governance practices and the appropriate human capabilities to make use of the info and take applicable actions.

This text was first printed on Bursa Maintain, Bursa Malaysia’s one-stop data hub that promotes and helps growth in sustainability, company governance and accountable funding amongst public-listed corporations.