Dwelling Depot: Purchase Step by step On Dips (NYSE:HD)

Table of Contents

jetcityimage/iStock Editorial through Getty Photographs

Introduction

As a dividend development investor, I search new funding alternatives in income-generating belongings. After I discover these belongings to be attractively valued, I usually add to my present positions. Moreover, I benefit from market volatility as we see it at this time by beginning new positions to diversify my holdings and improve my dividend earnings with much less capital.

Throughout a recession just like the one economist forecast, the patron discretionary sector could underperform as shoppers keep on with their fundamental bills. It may be a chance to judge corporations on this sector because the weak point could solely be short-term, but the long-term prospects stay intact. Certainly one of these corporations is Dwelling Depot (NYSE:HD), which traded for a excessive valuation for a very long time.

I’ll analyze the corporate utilizing my methodology for analyzing dividend development shares. I’m utilizing the identical technique to make it simpler to check researched corporations. I’ll look at the corporate’s fundamentals, valuation, development alternatives, and dangers. I’ll then attempt to decide if it is a good funding.

Looking for Alpha’s firm overview exhibits that:

The Dwelling Depot operates as a house enchancment retailer. It operates The Dwelling Depot shops that promote numerous constructing supplies, residence enchancment merchandise, garden and backyard merchandise, décor merchandise, and amenities upkeep, restore, and operations merchandise. The corporate additionally affords set up providers for flooring, cupboards and cupboard makeovers, counter tops, furnaces and central air techniques, and home windows. As well as, it gives device and tools rental providers.

Fundamentals

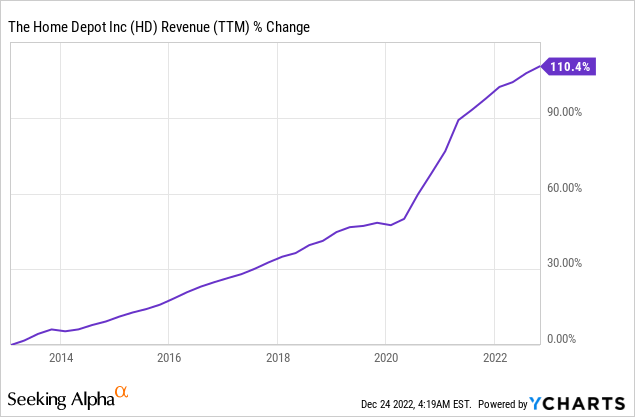

The revenues of Dwelling Depot have been steadily rising over the past decade. Gross sales have greater than doubled, which suggests they grew at an annual charge of virtually 8%. Gross sales elevated swiftly through the pandemic as extra folks spent extra time at residence. Thus its look grew to become extra essential for them. Sooner or later, as seen on Looking for Alpha, the analyst consensus expects Dwelling Depot to continue to grow gross sales at an annual charge of ~3% within the medium time period.

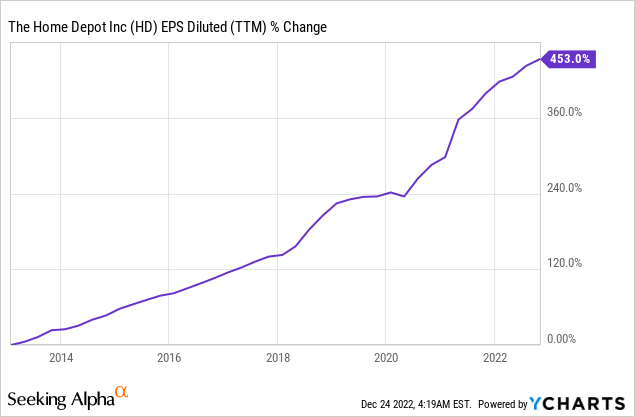

The EPS (earnings per share) has been rising a lot quicker throughout the identical interval. The EPS elevated by 450%, which suggests it’s greater than 5 occasions greater than it was only a decade in the past. The corporate achieved EPS development by rising gross sales, shopping for again its shares, and bettering margins by making a greater digital expertise and reducing prices. Sooner or later, as seen on Looking for Alpha, the analyst consensus expects Dwelling Depot to continue to grow EPS at an annual charge of ~5% within the medium time period.

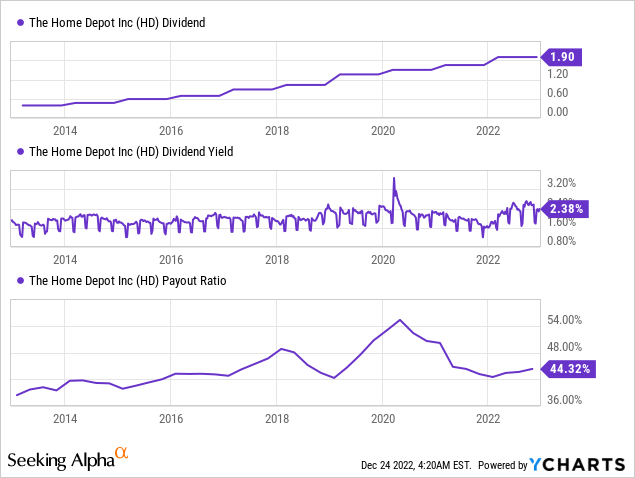

The corporate is a constant dividend payer. It hasn’t decreased the dividend for greater than thirty years and elevated it yearly for 13 years, together with a 25% improve final February. The dividend appears unlikely to be lower as the corporate pays lower than 50% of its EPS. Furthermore, the entry yield is greater than its ten-year common. Whereas the typical development charge over the past 5 years was 18%, traders ought to anticipate slower dividend development within the medium time period, because the EPS development is slowing down.

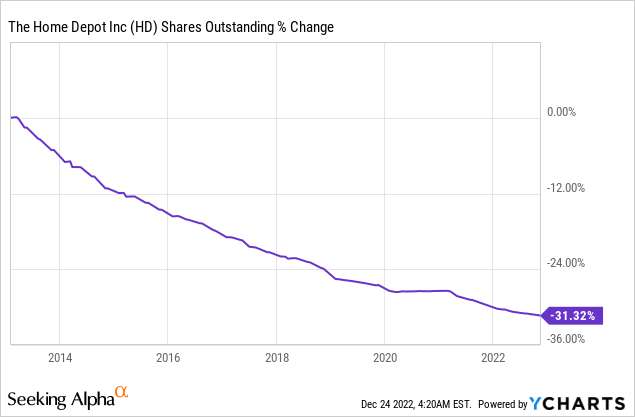

Along with dividends, corporations like Dwelling Depot reward their shareholders through share repurchase plans. Buybacks help EPS development over time as they decrease the variety of excellent shares. Dwelling Depot purchased again virtually one-third of its shares up to now ten years. Buybacks are extremely environment friendly when shares are attractively valued, and if the volatility persists, it could be a chance.

Valuation

The P/E (value to earnings) ratio of the Dwelling Dept is standing at 19.11 when taking into consideration the forecasted EPS of the present yr. It’s decrease at 18.8 when trying on the 2023 EPS forecast. Over the past twelve months, the valuation has decreased from a P/E ratio of 25 to a low of 16. The patron discretionary sector tends to be cyclical, so a difficult enterprise atmosphere impacts its valuation swiftly.

The graph beneath from Fastgraphs exhibits that Dwelling Depot is lastly at its historic valuation once more, a uncommon incidence within the final 5 years. The present P/E ratio is just like the P/E ratio we’ve got seen within the earlier twenty years. Nonetheless, traders also needs to bear in mind that the forecasted development charge for the corporate, which stands at 5% yearly, is slower than the 12% we noticed within the final twenty years.

Fastgraphs

Dwelling Depot affords traders some strong fundamentals with development in gross sales, EPS, dividends, and buybacks. The valuation of the inventory is consistent with its historic valuation. Whereas it could be tempting to leap right into a inventory at a historic valuation, it’s important to rigorously think about the corporate’s development prospects and potential dangers, as they could have a profound affect on its EPS development.

Alternatives

One alternative in investing in Dwelling Depot is the corporate’s strong financials and market management. Dwelling Depot is the most important residence enchancment retailer on this planet, with a presence in all 50 states and powerful model recognition. As well as, Dwelling Depot has a powerful stability sheet with a low debt-to-equity ratio and a powerful money place of greater than $2B. These components counsel that the corporate is well-positioned to climate financial downturns, proceed rising in the long run, and perhaps even purchase some opponents to enhance its worth proposition.

One other alternative in investing in Dwelling Depot is the rising demand for residence enchancment services. The pattern of house owners staying of their houses longer and investing in residence renovations has been rising in recent times, primarily due to the pandemic. Even because the economic system is again to regular, we nonetheless see distant work, studying, and hybrid jobs. Extra time at residence will see a corresponding improve in demand for residence enchancment services. It bodes properly for Dwelling Depot, as the corporate is well-positioned to capitalize on this pattern with its wide selection of services.

One other alternative in investing in Dwelling Depot is the corporate’s diversification. It affords not solely merchandise but additionally the providers to construct and set up them. It serves each finish customers and professionals who resell it to their purchasers. Furthermore, it’s increasing into new nations comparable to Canada and Mexico. Providing extra providers and merchandise in additional markets with an bettering digital worth proposition is significant for future development.

Dangers

One danger in investing in Dwelling Depot is the potential affect of financial downturns and recessions. Dwelling enchancment initiatives are sometimes thought of discretionary spending, that means they could be among the many first bills to chop throughout financial uncertainty. If the economic system have been to enter a recession, this might result in a decline in demand for residence enchancment services, which may negatively affect Dwelling Depot’s monetary efficiency.

One other danger in investing in Dwelling Depot is the competitors from different retailers and on-line sellers. The house enchancment retail market is very aggressive, with a number of outstanding nationwide and regional gamers vying for market share, as Dwelling Depot has a big 18% share. As well as, e-commerce has made it simpler for shoppers to buy residence enchancment merchandise on-line, doubtlessly resulting in a decline in retailer visitors for Dwelling Depot. Dwelling Depot is battling for market share and affords providers wanted to make use of the merchandise.

Along with the dangers talked about above, one other danger in investing in Dwelling Depot is the potential affect of rates of interest. Larger rates of interest could make it dearer for shoppers to finance residence enchancment initiatives, doubtlessly resulting in a decline in demand for the corporate’s services. It signifies that even when many shoppers weren’t affected by the recession, they could battle to finance costly home renovation initiatives. They could both delay it or spend time. Each are difficult for Dwelling Depot.

Conclusions

General, Dwelling Depot has sturdy fundamentals, a good valuation, and respectable alternatives for development. Nonetheless, it’s important to notice that the corporate additionally faces a number of dangers, notably within the quick and medium time period. Buyers ought to anticipate steady dividend development, but perhaps at a slower tempo within the coming years as the corporate sails by way of a harsher enterprise atmosphere.

After contemplating the entire above facets, I consider that Dwelling Depot is a HOLD on the present time. Buyers ought to think about slowly constructing a place within the firm over time by shopping for on dips. It could actually assist to common out the acquisition value and doubtlessly mitigate danger. Ranking it as a BUY would have meant that that is a lovely entry value. But, with slower development and unstable markets, I consider traders can buy regularly. A sexy value shall be a ahead P/E of 14-15, as we’ve got seen this yr.